56 Dividend Plays with RISING Dividends For 50 Straight Years

A SPECIAL REPORT ON THE DIVIDEND KINGS FOR 2024

‟The longer you hold these stocks, the greater your chance of growing wealth”

Dear Investor,

A typical mutual fund charges 1% of assets under management.

On a $1,000,000 account, that comes to $10,000 every single year in fees...

Call me crazy, but I believe the money you worked hard for should be yours to grow.

Wall Street missed the Tech-Stock Meltdown in 2000, they didn't see the housing bubble of 2007, in 2023 they were blindsided by the almost “extinction level event” of the second-largest bank failure in US history -- Silicon Valley Bank. So why would they be able to protect your money in 2024?

It's not just wall street, there are many enemies of your wealth.

Financial planners, brokers, and insurance agents who choose what to sell you based on what generates the biggest fees and commissions for them. And these costs come right out of your nest egg.

Politicians. They tell you whatever they think you want to hear. They say they’ll balance the budget. Create new jobs. Cut your taxes. Pick up your health-care tab. And safeguard Social Security too. All the while trading on insider information they get whilst making decisions about the country.

Financial gurus and “fortune tellers” claim to be able to predict the stock market’s cycles and direction based on secret technical “systems” – but history proves most of them have been completely wrong about all the biggest market trends. Still, that doesn’t stop them from putting forth new theories and “systems” which they promise this time will get it right.

Fund Managers. Whether they’re managing mutual funds or hedge funds, many of today’s fund managers are proving to be incompetent at best – and negligent at worst. They make pennies on the dollar for years by charging you fees and then make one huge mistake and completely collapse losing your hard-earned money.

Melvin capital had $8.7 billion under management. Melvin decided using pension fund and investor money GameStop was worth shorting — that resulted in the fund losing about $7 billion dollars in January 2021, a decision it never recovered from. Yet it is estimated that Gabe Plotkin's (founder of Melvin Capital) net worth is about $400 million. Looks like he lost investors’ money but not his own.

But the public is catching on in droves. For these so-called “objective advisors” – who have vested interests in what they recommend – the game is over. And many of them know it.

In this letter, I’ll show you how to obtain a truly independent investment research, plus how to actually MAKE PROFITS based on the predictable actions of a 50 year stellar track record of doing right by investors.

Come Join Our "Investor Revolution"

My name is Andrew Bentley, and I'm inviting you to join a groundswell of investors who have vowed to "just say no" to these and the many other grifters. This message is also your "early warning alert" that these and other enemies of your wealth will be lying in ambush for you once again as we move into 2024.

To combat these enemies of wealth, I have been researching companies which are some of America's largest and most powerful corporations, yet they go out every day working for you, the shareholder, and not just for its executives and employees.

I'll tell you how to profit from this exclusive list of stocks -- and also give you the independence to manage your own hard-earned money.

This list of exclusive stocks provides:

- FORTRESS-LIKE PROTECTION against all the enemies of your wealth. They include not only people, but things such as inflation, recessions, volatile markets, etc., all of which I’ll talk about in a moment. I am unabashedly fanatical in my conviction that the number one rule of building wealth is that you must not lose what you already have.

- EXTREME SELECTIVITY. The second part of my message is equally simple. To multiply your wealth, you really don’t need lots of investments. But the ones you choose should offer truly extraordinary potential at extremely low risk, if possible, zero risk.

Rest assured, you’ll not see this type of research and analysis anywhere else. And, best of all, this research is completely untainted by monetary concerns or other “special interests.”

Unlike most financial advisors, I don’t work for commissions. I’m not interested in earning fees of your portfolio. And I have zero interest in “capturing your assets.” For years I’ve heard financial guru’s say buy this stock It’s going to rip this week or buy Gold it’s about to break out, but the gold price has barely moved since 2020 even though inflation has been rampant. I think it’s time we take a different approach. An approach that has been tested and proven to work over the last 50 years.

I want to start by telling you a story about Thomas, who has been using this strategy for decades and... well... I’ll let David; Thomas’s son tell you the story.

I'm David, and my dad, Thomas, was the cornerstone of our family. He dedicated thirty years of his life to Philip Morris, accumulating a substantial amount of their stock through an employee purchase program. He also had a good chunk of MO shares. Those investments brought in a steady flow of dividends, around $175k to $200k each year.

When my dad passed away, financial advisors bombarded us with warnings about having all our eggs in one basket. They urged us to diversify, especially considering the uncertain future of the tobacco industry. It made sense, and I was particularly nervous about the risks associated with PM and MO.

Dad, however, remained steadfast in his belief in the power of dividends. Whenever I brought up diversification, he'd calmly say, "If they cut the dividend, I'll think about it." Despite the occasional market downturns, he held onto his stocks, unfazed by the fluctuations.

After his passing, I decided to heed the advice of the financial experts and diversified our investments. It was a prudent decision, but I couldn't help but admire my dad's unwavering confidence in his investment strategy. He weathered the storms of the market with grace, always trusting in the steady income stream that his stocks provided.

Every year I’d hear him say “Damn government makes me take out these RMD’s (Required Minimum Distribution) and I don’t need the money.”

In the end, after he’s gone, my mom is in assisted living. Her RMD is about $200k per year. It pays for all her care. I hear people talk about their parents being broke and having to move in with them. I’m very fortunate to know I don’t have to pay for my mom’s care.

My dad's foresight and financial acumen ensured that my mom's needs were fully taken care of. The dividends from his investments, coupled with her RMD, provided a comfortable and secure life for her in assisted living. It was a relief knowing that she was well-provided for, and I didn't have to bear the burden of her care financially.

As I reflected on our family's journey, I couldn't help but feel immensely grateful for the stability and security that my dad's investment strategy had afforded us. It was a testament to his wisdom and foresight, and it gave me peace of mind knowing that my mom's needs were taken care of, even in his absence.

So why is this list of stocks so exclusive

and what does it take to become a Dividend King?

Dividend kings are an elite group of stocks that have increased their dividends every year for at least 50 years in a row. Not surprisingly, a relatively small number of companies ever reach this benchmark. Out of more than 4,000 public companies in the U.S., only 56 make the cut in 2024.

Why you should invest in the dividend kings?

The Dividend Kings gives you a unique combination of advantages, Here are 7 reason’s why the Dividend Kings will help you build passive income:

-

1) Rising payouts to shareholders every year for at least 50 years

A cash dividend is the only real evidence that a company is doing its job of working for you, the shareholder, and not just for its executives and employees. Think about all the corporate scandals, accounting schemes and fictitious earnings reports of the recent past. Now, consider the satisfaction of receiving a check in the mail or a deposit directly into your brokerage account. It is comforting to know that a company earned enough money to pay you, the shareholder.

-

2) The safety and security of being some of America’s largest and most powerful corporations

Companies that offer steady dividends are often well-established and profitable. No companies exhibit this better than dividend kings. This list of exclusive stocks has raised dividends for at least 50 straight years.

That's no small feat, given that these companies have raised and paid dividends through seven recessions, an oil embargo (1973-74), double-digit interest rates (the 1980s), Black Monday (1987), 9/11, the dot-com bubble (1999-2000), the 2008 financial crisis, the Coronavirus Crash of 2020, and other events over the last five decades.

-

3) Passive Income every single year that you can put in your pocket

Most investors like dividend stocks because they can provide a steady source of income with little or no work, much like interest from a bank account but with a greater potential for return on investment.

Although expecting dividend-paying companies to continue to make good on their dividend payouts may sound a little risky, the fact is that mature, well-established companies will go to great lengths to not only keep their dividends consistent and predictable, but to increase the amounts paid out on a regular basis.

Stable dividends are one of the most important factors in a company’s ability to keep its stock price strong, and dividend-paying companies make it a priority to do whatever is necessary to maintain a healthy financial position.

-

4) Lower risk

The prospect of a dividend payment helps to buoy a stock, while a non-dividend payer is vulnerable to a deep fall since it lacks cash payment to keep investors from selling their shares.

A corporate requirement to pay regular dividends instills the same kind of discipline on a company’s management as a mortgage payment does on someone who is paying off a home loan.

-

5) Cushion stock values during recessions

It is during bear markets when dividend-paying stocks really shine. The dividend payout provides a cushion when growth stocks are faltering. You still get your quarterly, monthly, or annual dividends no matter if it's Biden or Trump that is president.

A company that pays dividends is like an investor who commits to a 401(k) or a savings plan. The money that is used to pay dividends is not naturally available to be squandered on risky projects that a disciplined management team would forgo.

-

6) Low rates of corporate scandals

Cash dividends are not subject to revisions, unlike corporate earnings. Revenues can be booked in one year or spread over several years. Capital assets can be sold and listed as ordinary income. Liability can be accounted for during a single year or spread out over several years.

However, cash paid into your account is a litmus test for true corporate earnings. While there have been a few dividend scandals, they are extremely rare. The reality is that dividends must be paid out of earnings, so there is no corporate trickery. To quote the title of Geraldine Weiss’ classic book, “Dividends Don’t Lie.”

-

7) Invest Once and Profit Twice

When you invest in dividend stocks, you stand to profit in more ways than one.

We already understand the potential for regular payouts offered by dividend investing, but there is also a return on investment when your share prices increase.

Non-dividend-paying stocks only offer a potential for profit when you buy their shares at a low price and sell them for a higher one.

Dividend stocks, on the other hand, allow you to share in company profits while also retaining ownership of your investment. And since many dividend-paying companies are financially stable and relatively reliable, their stock prices tend to increase over time, as their perceived investor value continues to grow.

What you will get from the Dividend Kings Report?

Super Investors is trusted by more than 1,000 members to find the best stocks for their retirement and financial freedom portfolios, while avoiding mediocre or worse investments.

To accomplish this, our in-house research team analyzes and creates to-the-point 3-page reports on income stocks quarterly.

Think of our analysts as your personal team of income stock researchers who are constantly working to find the best income stocks for your portfolio, as well as which stocks to avoid.

We do the ‘heavy lifting’ of income analysis so you can reap the benefits of investing in high quality dividend growth stocks.

Here’s What Your Dividend Kings Report Includes:

- To-The-Point 3-page Reports on each stock in the Dividend Kings list for 2024

- Each Report will Include Metrics that matter like:

- 5-year forward expected total returns

- Dividend Risk scores

- Retirement Suitability scores

Investment Method

We use the same investing metrics for all stocks so that it's easy for you to compare on an apples-to-apples basis. These metrics include:

- 5-year forward expected total returns

- Fair value prices

- Buy/hold/sell ratings

- Dividend Risk scores

- Retirement Suitability scores

- And much more

Investing Framework: Expected Total Returns

All returns come from only three sources:

- Dividends (or distributions, interest, etc.)

- Growth on a per share basis (typically measured as earnings-per-share)

- Valuation multiple changes (typically measured as a change in the price-to-earnings ratio)

Combined, these three sources make up total return.

Historical total return, while interesting, is not what matters in investing. It’s expected future returns that we care about.

And since total returns can only come from three sources, you can use the expected total return framework to clarify your thinking on where you expect total returns to come from.

Our analysts have calculated five-year forward expected total return estimates for the stocks in the Dividend Kings Report.

This means you can compare the total return profiles of the Dividend Kings to one another using the same framework. This makes it easy for you to figure out which Dividend Kings are a good fit for your portfolio.

Investing Framework: Dividend Risk & Retirement Suitability

Expected total returns are one side of the investing coin. The other is risk.

We are focused on income producing stocks because that’s what matters for a sustainable retirement (or early retirement).

The primary risk with dividend investing is dividend reductions or dividend eliminations.

That’s where the Dividend Risk Score comes in. We assign a letter grade ranking to all the income-paying stocks in the Dividend Kings Report using the Dividend Risk Score. So you know if its an A it's a low risk, If its an F the stock has a higher risk of it's dividend being cut.

Dividend Risk Scores take into account:

- Recession performance

- Dividend history

- Payout ratio

- The longer a company’s streak of consecutive dividend increases, the lower its payout ratio, and the better its historical (and/or expected) recession performance, the better its Dividend Risk Score

The Dividend Risk Score helps you to quickly compare the relative dividend safety of each Dividend King.

When investing for retirement income, the actual yield of your investment matters a great deal. All other things being equal, the higher the yield the better.

The Retirement Suitability Score is a combination of an investment’s Dividend Risk Score and its dividend yield. Securities with a safe Dividend Risk Score and a high yield will have the best Retirement Suitability Scores.

How To Use This Information

Five year forward expected total returns, Dividend Risk Scores, and Retirement Suitability Scores give you the power to quickly compare different individual investment options to one another.

A diversified portfolio of dividend-oriented stocks tends to outperform a portfolio of non-dividend-paying stocks, both domestically and internationally over the long haul. Seldom do you find a high-flying stock that has a large market capitalization and pays a sizable dividend. Studies also show that dividend-paying stocks are less risky than non-dividend payers. By investing in stable companies, you avoid the high-wire ventures of aggressive growth stocks. Remember the technology bubble of the late 1990s? When you invest in dividend-paying stocks, you avoid buying shares of public companies such as Enron and eToys. Both of those companies flamed out, with Enron’s accounting scandal bringing the company to an embarrassing end. It is during bear markets when dividend-paying stocks really shine. The dividend payout provides a cushion when growth stocks are faltering. The prospect of a dividend payment helps to buoy a stock, while a non-dividend payer is vulnerable to a deep fall since it lacks cash payment to keep investors from selling their shares. To be clear, dividend payers can lose value, but they tend not to fall as much as aggressive growth stocks that do not make payments to their shareholders.

To survive and prosper in this dangerous arena, remember the rules:

- 1) Diversify into several investments

- 2) Watch your investments closely and protect your principal.

- 3) Have a margin of safety: Be patient and wait to buy after a big sell-off due to a new government policy, a change in the direction of interest rates, large investors bailing out or corporate issues that don't affect the company’s business model or reputation etc.

- 4) Focus on stocks with a long track record of doing right buy investors

- 5) Look at the stock as a business not just something to trade in and out of

- 6) Look for companies with a unique product or service that you can understand and gives them a competitive advantage which cannot be easily replicated

- 7) Ensure the company's profit margins are healthy and revenues are growing

Top 5 Dividend Kings with free reports

The following 5 stocks are our top-ranked Dividend Kings today, based on expected annual returns over the next 5 years. Stocks are ranked in order of lowest to highest expected annual returns.

Total returns include a combination of future earnings-per-share growth, dividends, and any changes in the P/E multiple.

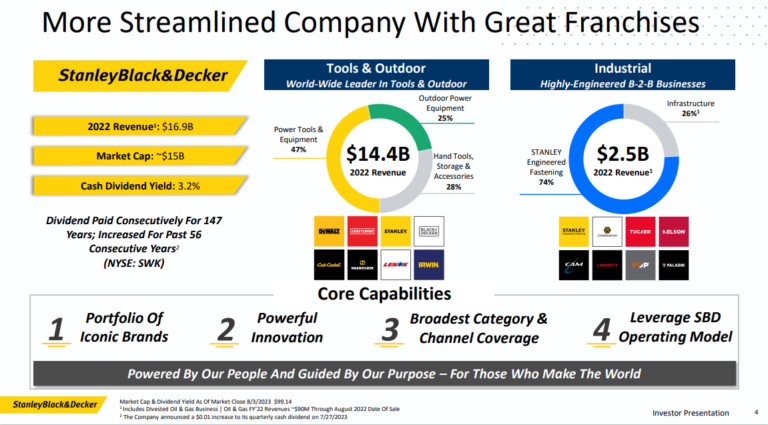

#5 Dividend King: Stanley Black & Decker (SWK)

5-Year Annual Expected Returns: 12.5%

Stanley Black & Decker is a world leader in power tools, hand tools, and related items. The company holds the top global position in tools and storage sales. Stanley Black & Decker is second in the world in the areas of commercial electronic security and engineered fastening.

Stanley Works and Black & Decker merged in 2010 to form the current company, thought the company can trace its history back to 1843. Black & Decker was founded in Baltimore, MD in 1910 and manufactured the world’s first portable power tool.

On October 27th, 2023, Stanley Black & Decker reported third quarter results for the period ending September 30th, 2023. For the quarter, revenue decreased 4.1% to $3.95 billion, which was $20 million less than expected. Adjusted earnings-per-share of $1.05 compared favorably to $0.76 in the prior year and was $0.22 above estimates.

Want the full research on Black & Decker?

Access detailed coverage on Black & Decker

#4 Dividend King: National Fuel Gas (NFG)

5-Year Annual Expected Returns: 13.0%

National Fuel Gas Co. is a diversified energy company that operates in five business segments: Exploration & Production, Pipeline & Storage, Gathering, Utility, and Energy Marketing. The largest segment of the company is Exploration & Production. With 53 years of consecutive dividend increases, National Fuel Gas qualifies to be a Dividend King.

In early November, National Fuel Gas reported (11/1/23) financial results for the fourth quarter of fiscal 2023. The company grew its production 7% over the prior year’s quarter thanks to the development of core acreage positions in Appalachia. However, the average realized price of natural gas fell -18%, from $2.84 to $2.33.

As a result, adjusted earnings-per-share declined -34%, from $1.19 to $0.78, and missed the analysts’ consensus by $0.07. The company has beaten the analysts’ estimates in 15 of the last 18 quarters.

Want the full research on National Fuel Gas?

Access detailed coverage on National Fuel Gas

#3 Dividend King: SJW Group (SJW)

5-Year Annual Expected Returns: 13.2%

SJW Group is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine. SJW Group has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $630 million in annual revenues.

On October 30th, 2023, SJW Group reported third quarter results for the period ending September 30th, 2023. For the quarter, revenue increased 16.4% to $204.8 million, which was $17.8 million better than expected. Earnings-per-share of $1.13 compared favorably to earnings-per-share of $0.82 in the prior year and was $0.18 above estimates.

#2 Dividend King: Archer-Daniels Midland (ADM)

5-Year Annual Expected Returns: 16.6%

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. The company, founded in 1902, trades with a market capitalization of $38.6 billion. Archer-Daniels-Midland’s businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter results for Fiscal Year (FY) 2023 on October 24th, 2023. The company delivered robust financial results for Q3 2023 in the face of dynamic market conditions. Juan Luciano, Chair and CEO, highlighted strategic initiatives, including investments in innovation and operational efficiency, to meet evolving customer needs.

The Ag Services & Oilseeds segment excelled, leveraging Brazilian export capabilities and addressing renewable green diesel demand through the Spiritwood production facility. Carbohydrate Solutions posted outstanding results, particularly in ethanol, starches, and sweeteners.

#1 Dividend King: 3M Company (MMM)

5-Year Annual Expected Returns: 20.0%

3M is an industrial manufacturer that sells more than 60,000 products used daily in homes, hospitals, office buildings, and schools worldwide. It has about 95,000 employees and serves customers in more than 200 countries.

On January 23rd, 2024, 3M announced fourth quarter and full year earnings results for the period ending December 31st, 2023. For the quarter, revenue decreased 0.3% to $7.69 billion, which missed estimates by $30 million. Adjusted earnings-per-share of $2.42 compared to $2.28 in the prior year and was $0.11 more than expected.

For 2023, revenue was lower by 4.5% to $32.7 billion while adjusted earnings-per-share of $9.24 compared to $10.10 in the prior year. However, comparable adjusted earnings-per-share totaled $9.88 in 2023.

Want in-depth analysis on all 56 Dividend Kings?

Get the same to-the-point 3 page detailed reports on all the Dividend Kings to help you find the best income stocks for your retirement and financial freedom portfolios, while avoiding mediocre or worse investments.

The Dividend Kings Report is normally $249.99. But if you act now, you can get the report for just $79.99 -- a $170 savings.

When You Buy, You're Protected By My Double Guarantee of Satisfaction:

GUARANTEE #1

If at any time during the first 30 days, you change your mind about Dividend Kings Report, Just let us know. I guarantee you will receive a prompt and full refund of every penny you've paid.

GUARANTEE #2

All research and materials you've received will be yours to keep FREE.

Don’t just take our word for it see what investors say about Dividend Kings Report:

NO Risk Guarantee

If, within 30 days of receiving the report, you decide that the report isn’t right for you, I will give you a full refund -- No questions asked. Just email us at [email protected]

Top-Notch Customer Service:

Our customer service is handled by real humans. It’s not outsourced to AI or farmed off to people who don’t understand the intricacies of dividend investing. Feel free to ask detailed investing questions. In almost all cases we will answer in one business day or less. Once again our email is [email protected]

You’re only one step away from getting detailed coverage on all the Dividend Kings that could change how much income you make in 2024. Remember, with our no-risk guarantee, you have nothing to lose. Simply click on the "Get the report" button below.