Worst Investors

The worst performing investors this year

Your smart, good looking friend that sends you an email everytime a super investor makes a big move. Don't miss the opportunity to make millions

-

-

Bill Ackman

Pershing Square - -88.80% last year

- $8.96 Billion portfolio:

-

CMG (21.7%)

-

HLT (20.7%)

-

-

Seth Klarman

Baupost Group - -37.76% last year

- $3.01 Billion portfolio:

-

CCC (29.4%)

-

GOOG (15.8%)

-

-

George Soros

Soros Fund - -30.96% last year

- $2.41 Billion portfolio:

-

GOOGL (9.9%)

-

AER (7.0%)

-

-

Carl Icahn

Icahn Capital - -30.27% last year

- $10.9 Billion portfolio:

-

IEP (61.3%)

-

CVI (15.2%)

-

-

Michael Burry

Scion Asset Management - -26.47% last year

- $96.4 Million portfolio:

-

BABA (10.0%)

-

JD (9.3%)

-

-

Jim Chanos

Kynikos Associates - -20.54% last year

- $4.51 Million portfolio:

-

KRE (57.8%)

-

QQQ (20.6%)

-

-

Tom Russo

Gardner Holdings - -17.10% last year

- $9.53 Billion portfolio:

-

BRK.A (13.7%)

-

GOOG (11.9%)

-

-

Guy Spier

Aquamarine Capital - -16.44% last year

- $261 Million portfolio:

-

BRK.B (21.9%)

-

AXP (18.2%)

-

-

Cathie Wood

Ark Invest - -15.96% last year

- $10.4 Billion portfolio:

-

TSLA (10.2%)

-

COIN (6.5%)

-

-

Prem Watsa

Fairfax - -13.10% last year

- $1.13 Billion portfolio:

-

OXY (30.0%)

-

ORLA (16.3%)

-

-

Bill Gates

Gates Foundation - -7.47% last year

- $43.3 Billion portfolio:

-

MSFT (33.3%)

-

WM (16.4%)

-

-

Mario Gabelli

Gamco - -6.38% last year

- $9.35 Billion portfolio:

-

MLI (2.6%)

-

CR (2.3%)

-

-

Tom Gayner

Markel Corp - -5.39% last year

- $10.1 Billion portfolio:

-

BRK.A (6.8%)

-

BRK.B (6.2%)

-

-

Ron Baron

Baron Funds - -4.09% last year

- $35.2 Billion portfolio:

-

TSLA (9.7%)

-

ACGL (5.7%)

-

-

Li Lu

Himalaya Capital - -3.04% last year

- $2.34 Billion portfolio:

-

BAC (28.3%)

-

GOOG (20.9%)

-

-

Ken Griffin

Citadel - -1.37% last year

- $93.7 Billion portfolio:

-

SPY (2.0%)

-

PXD (1.6%)

-

-

Howard Marks

Oaktree Capital - -1.28% last year

- $5.15 Billion portfolio:

-

TRMD (35.2%)

-

CHK (9.7%)

-

-

David Abrams

Abrams Capital - -0.75% last year

- $3.13 Billion portfolio:

-

LAD (21.1%)

-

ABG (15.5%)

-

-

Gabe Plotkin

Melvin Capital - +0.00% last year

- $0 portfolio:

-

WWE (Sold)

-

BURL (Sold)

-

-

Jim Simons

Renaissance Tech - +0.26% last year

- $60.2 Billion portfolio:

-

NVO (2.3%)

-

PLTR (1.9%)

-

-

Yacktman

Yacktman Asset Management - +1.04% last year

- $10.6 Billion portfolio:

-

CNQ (9.2%)

-

MSFT (5.7%)

-

-

Ray Dalio

Bridgewater - +1.81% last year

- $18.6 Billion portfolio:

-

IVV (5.9%)

-

IEMG (5.1%)

-

-

Chris Davis

Davis Advisers - +1.84% last year

- $17 Billion portfolio:

-

META (8.6%)

-

COF (7.5%)

-

-

Jeremy Grantham

Gmo Asset Management - +2.47% last year

- $26.6 Billion portfolio:

-

MSFT (5.3%)

-

GOOGL (4.1%)

-

-

Steven Cohen

Point72 Asset Management - +5.34% last year

- $31.3 Billion portfolio:

-

AMZN (1.9%)

-

T (1.5%)

-

-

Terry Smith

Fundsmith - +5.53% last year

- $25.1 Billion portfolio:

-

MSFT (12.0%)

-

META (9.4%)

-

-

Ken Fisher

Fisher Asset Management - +6.30% last year

- $197 Billion portfolio:

-

AAPL (5.9%)

-

MSFT (5.2%)

-

-

Joel Greenblatt

Gotham Asset Management - +7.08% last year

- $6.26 Billion portfolio:

-

SPY (10.3%)

-

GSPY (5.7%)

-

-

Nicolai Tangen

Ako Capital - +7.29% last year

- $6.79 Billion portfolio:

-

ALC (8.6%)

-

MSFT (6.5%)

-

-

Julian Robertson

Tiger Management - +8.46% last year

- $3.14 Million portfolio:

-

VOO (97.0%)

-

SWKS (Sold)

-

-

Brian Macauley

Broad Run - +9.00% last year

- $862 Million portfolio:

-

ASTS (8.5%)

-

BN (7.8%)

-

-

Chris Hohn

Tci Fund - +9.59% last year

- $38.6 Billion portfolio:

-

GE (19.2%)

-

MCO (13.9%)

-

-

Stan C. Moss

Polen Capital - +10.22% last year

- $41.4 Billion portfolio:

-

AMZN (13.4%)

-

MSFT (9.2%)

-

-

Daniel Loeb

Third Point - +11.66% last year

- $7.41 Billion portfolio:

-

PCG (13.9%)

-

AMZN (11.1%)

-

-

Warren Buffett

Berkshire Hathaway - +12.22% last year

- $354 Billion portfolio:

-

AAPL (46.6%)

-

BAC (9.8%)

-

-

Jeffrey Ubben

Valueact - +14.74% last year

- $3.97 Billion portfolio:

-

CRM (23.6%)

-

NSIT (18.4%)

-

-

Mark Massey

Altarock Partners - +14.76% last year

- $4.64 Billion portfolio:

-

TDG (30.2%)

-

MSFT (14.9%)

-

-

Pat Dorsey

Dorsey Asset Management - +15.40% last year

- $885 Million portfolio:

-

META (15.4%)

-

GOOG (15.4%)

-

-

Sean Stannard-Stockton

Ensemble Capital - +15.92% last year

- $1.13 Billion portfolio:

-

GOOGL (8.2%)

-

NFLX (7.9%)

-

-

Charlie Munger

Daily Journal - +16.02% last year

- $169 Million portfolio:

-

WFC (43.6%)

-

BAC (43.4%)

-

-

Chuck Akre

Akre Capital - +17.14% last year

- $12.4 Billion portfolio:

-

MA (16.4%)

-

MCO (15.7%)

-

-

Glenn Greenberg

Brave Warrior Advisors - +17.39% last year

- $4.64 Billion portfolio:

-

ANTM (17.1%)

-

FNF (10.6%)

-

-

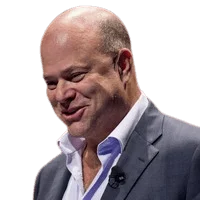

David Tepper

Appaloosa Lp - +18.91% last year

- $6.04 Billion portfolio:

-

BABA (14.3%)

-

AMZN (10.2%)

-

-

Chase Coleman Iii

Tiger Global - +20.10% last year

- $16.1 Billion portfolio:

-

META (22.1%)

-

MSFT (13.2%)

-

-

Stanley Druckenmiller

Duquesne Family Office - +22.73% last year

- $3.56 Billion portfolio:

-

CPNG (12.8%)

-

MSFT (12.3%)

-

-

David Einhorn

Greenlight Capital - +23.97% last year

- $2.33 Billion portfolio:

-

GRBK (33.8%)

-

THC (8.2%)

-

-

Mohnish Pabrai

Pabrai Funds - +39.41% last year

- $187 Million portfolio:

-

AMR (54.0%)

-

CEIX (17.4%)

-

-

Cliff Sosin

Cas Investment Partners - +41.26% last year

- $1.32 Billion portfolio:

-

CVNA (66.9%)

-

HGV (18.4%)